“If we command our wealth, we shall be rich and free. If our wealth commands us, we are poor indeed.” – Edmund Burke.

Finance has become more critical than it ever had been. Everyone is concerned and willing to manage finances. In this tech-savvy world, youth have many opportunities to learn, grow and apply those skills to earn money. Hence, it needs the knowledge of finance to handle its own finances and invest them.

Understanding the need for the hour, LPU organized a session named “Money Matters for future wealth creation and healthy living”. This event was arranged on 30th June 2021 to make students financially literate under SEBI’s (Security Exchange Board of India) guidelines.

The session was held by Dr. Sachin Khullar, the youngest CFA (Chartered Financial Analyst) of 2010 who has been in the education sector for more than a decade. He has done great work in the education sector, acquiring international world records like Guinness World Record and published researches in renowned journals. He is a brain science expert associated with ScoreMantra and MindMap, through which he empowers young minds.

Brief About the Session

It was an illuminating session that started with a brief description of inflation and its effects on income or savings. Then came the “power of compounding”. Dr. Khullar specified that a small amount compounded for the long-term can turn into affluence in the future. He told the students that proper asset allocation, diversification, and specific financial goals are crucial to financial literacy.

Asset allocation can be realized as a “balanced thaali”, which has every dish you want to have.

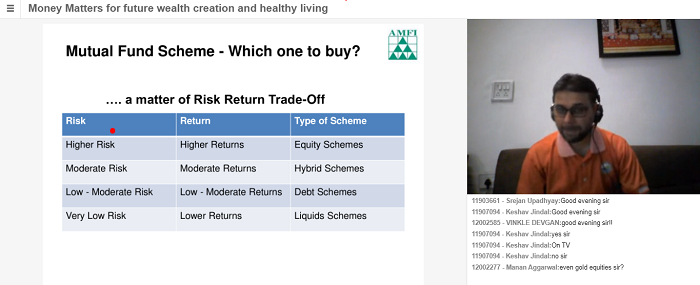

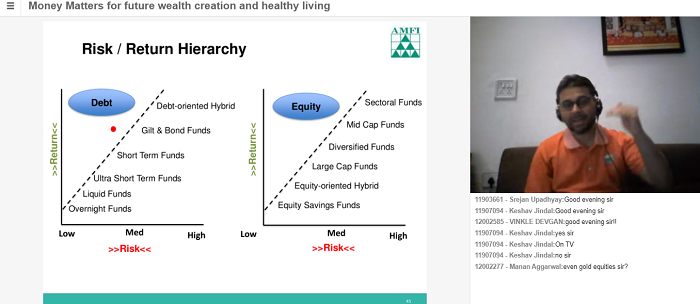

According to Dr.Khullar, mutual funds are the most convenient, low-cost, transparent, and well-regulated investment option for investors. He suggested that equity funds are for long-term investment and higher risk-appetite investors. Contrary to this, debt funds work on interest and capital appreciation, making them moderate-risk investments.

Then there are some index funds, ETFs, gold funds, international funds, FoF, etc. Then he went to explain the different scheme-related documents, modes of investments, and factsheets which are often neglected when people talk about investments. The session ended with a practical guide of investment in mutual funds.

Key Takeaways of the Session

- Investments are helpful only if they could fight the inflation rate.

- Assets should be accessible and usable in parts and portions.

- Compounding is the best way of investing your income in getting the best results.

- Your investment portfolio should be diversified and should realize your financial goals.

The recording of this session is on the class platform for LPU’s Vertos to uncover the world of finance.

This was a great initiative by Lovely Professional University and SEBI.